Pakistan is stepping boldly toward a cashless economy in 2025, and at the heart of this transformation is Raast Pakistan — the country’s first real-time digital payment system. Powered by the State Bank of Pakistan (SBP), Raast aims to make instant, secure, and low-cost transfers accessible to every citizen — whether you’re a freelancer getting paid, a small shop owner, or someone just splitting a restaurant bill.

According to the SBP’s latest report, over 35 million transactions worth hundreds of billions of rupees have already been processed through Raast, proving that Pakistanis are rapidly adopting digital finance solutions faster than ever before.

I’m Adnan from Lahore, and I personally test Pakistan’s leading fintech apps — from Easypaisa and JazzCash to Raast — to find out which one truly delivers when it comes to speed, convenience, and trust. In this guide, I’ll break down Raast vs Easypaisa 2025 — how both work, their pros and cons, and most importantly, which platform actually gives you the smoothest instant payment experience in Pakistan.

By the end of this article, you’ll know exactly:

- Which app or platform is best for instant transfers

- Which one handles bills, QR payments, and mobile top-ups more efficiently

- And whether Raast App could eventually replace Easypaisa as Pakistan’s go-to payment system.

Let’s dive into the future of instant payments in Pakistan — and see which platform truly deserves your trust in 2025.

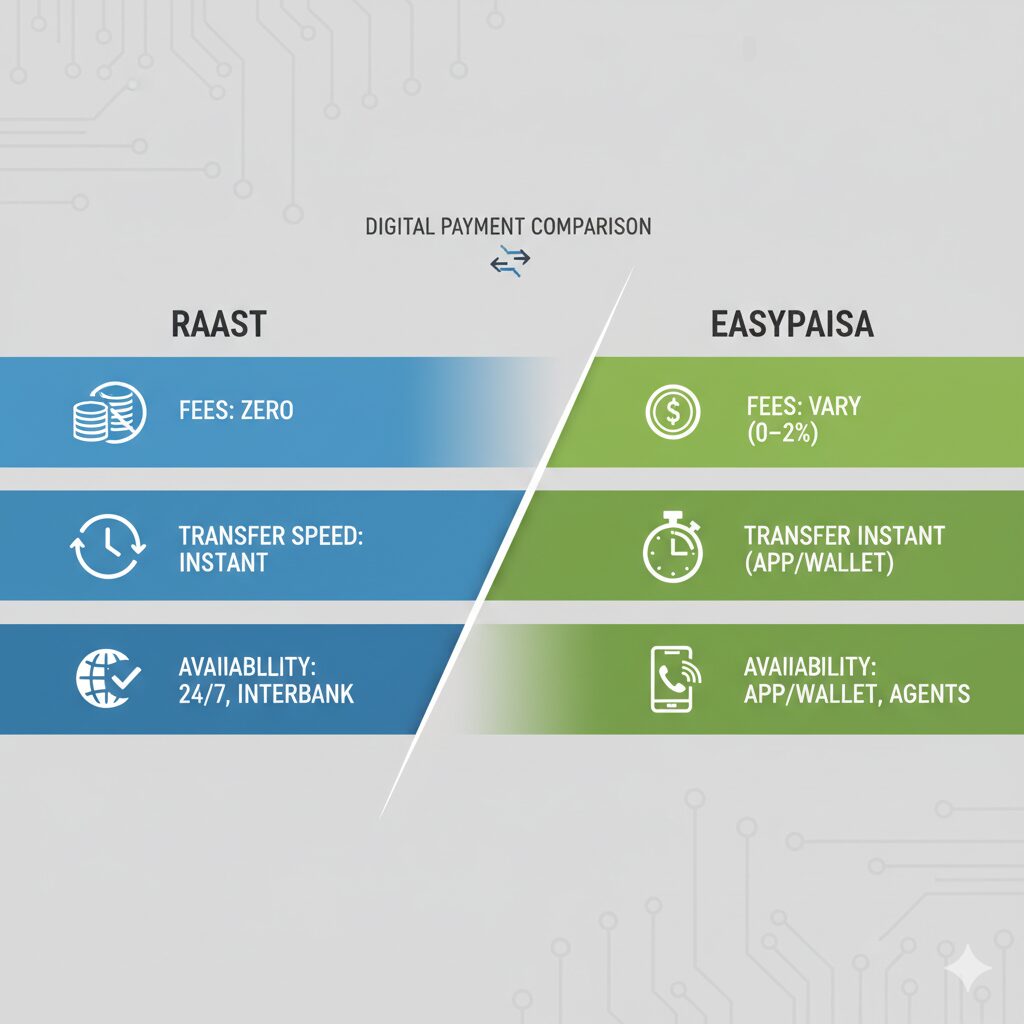

Quick Comparison: Raast vs Easypaisa 2025

Before diving deeper, here’s a quick look at how Raast vs Easypaisa (2025) stack up side by side. Both aim to simplify instant digital payments in Pakistan, but they serve slightly different audiences — Raast for bank-based users and businesses, Easypaisa for everyday wallet users.

| Feature | Raast | Easypaisa |

|---|---|---|

| Owner | State Bank of Pakistan | Telenor Microfinance Bank |

| Type | National Instant Payment System | Private Mobile Wallet |

| Fees | Free (for now) | Small charges on some transfers |

| Availability | All banks & wallets (nationwide) | Easypaisa app only |

| Transfer Speed | Instant (bank to bank) | Instant (wallet to wallet) |

| Best For | Bank users, freelancers, businesses | Wallet users, general public |

💡 Key Takeaway

Raast is a national infrastructure built by the State Bank of Pakistan, ensuring inter-bank instant transfers at zero cost — ideal for businesses and anyone connected to a bank account.

Easypaisa, on the other hand, shines for non-banked users who prefer a quick, app-based wallet for daily expenses, QR payments, and mobile top-ups.

What Is Raast? (The State-Backed Instant Payment Network)

Raast Pakistan is the country’s official instant payment system, launched by the State Bank of Pakistan (SBP) to modernize how money moves across banks, wallets, and individuals.

Unlike private fintech apps, Raast is a public digital infrastructure — meaning every licensed bank and payment service provider in Pakistan can connect to it.

The mission of Raast is simple yet revolutionary:

to enable real-time, low-cost, and secure digital payments between people, businesses, and government institutions — without depending on cash or long transfer delays.

Today, Raast transfers are integrated into almost every major bank and wallet in Pakistan — including HBL, Meezan Bank, NBP, Bank Alfalah, Easypaisa, JazzCash, and UBL.

Users can send or receive money instantly, even across different platforms, without needing long account numbers.

How Raast Works

Using Raast is straightforward:

- Open your bank app (e.g., HBL, Meezan, or Easypaisa).

- Link your CNIC or mobile number to your account through the Raast option.

- Send or receive money instantly using a CNIC, phone number, or IBAN.

There’s no separate Raast App — it’s built inside existing banking apps, making it accessible to anyone with a bank account. This seamless integration means you can transfer funds between different banks or wallets in seconds, 24/7, without paying any fee (for now).

✅ In short: Raast isn’t another fintech app — it’s the national payment backbone powering Pakistan’s digital economy.What Is Easypaisa? (Pakistan’s Most Popular Mobile Wallet)

Easypaisa Pakistan has been a pioneer in digital finance since its launch by Telenor Microfinance Bank in 2009. Licensed and regulated by the State Bank of Pakistan, Easypaisa started as a simple mobile-to-mobile money transfer service and has now evolved into a complete digital wallet used by over 40 million Pakistanis.

In Easypaisa 2025, the app offers almost everything —

✅ Instant wallet-to-wallet transfers

✅ Bill payments and mobile top-ups

✅ Debit card (virtual and physical)

✅ QR payments at shops

✅ and now, Raast integration for instant inter-bank transfers

This Raast integration means Easypaisa users can now send or receive Raast payments directly inside the Easypaisa app — bridging the gap between bank accounts and wallets.

Whether you’re transferring to a JazzCash user, sending money to a bank account, or receiving from a business, Easypaisa now connects seamlessly through Raast’s secure network.

💡 In short: Easypaisa remains Pakistan’s most popular mobile wallet for daily use, while Raast powers the national instant payment rails that Easypaisa now runs on.Raast vs Easypaisa: Side-by-Side Comparison (2025 Update)

Both Raast and Easypaisa have changed how Pakistanis send and receive money — but they work differently under the hood.

Let’s break down the real-world differences between Raast transfers vs Easypaisa in 2025.

Account Setup & Access

Raast works through your existing bank app — whether it’s HBL, Meezan, NBP, or UBL. You don’t need to download a separate Raast app; it’s built directly into Pakistan’s top banking platforms.

Easypaisa, on the other hand, is a standalone mobile wallet. Anyone can create an account using their CNIC and phone number, even if they don’t have a bank account. This makes it ideal for the unbanked population.

Fees & Charges

Raast transfers are 100% free — you can send money between any bank or wallet without paying a single rupee.

Easypaisa offers mostly free wallet transfers too, but some transactions (like sending to other wallets or withdrawing cash) may include small service charges.

💡 Winner: Raast — because it’s completely free for now, making it unbeatable for cost-efficient digital payments.Speed & Reliability

Both platforms deliver instant payments, but Raast is designed for high-value, inter-bank transfers. Since it runs directly through the State Bank’s infrastructure, it handles large transactions with more stability and less downtime.

Easypaisa remains fast for wallet-to-wallet transfers, especially for everyday use like mobile top-ups or bill payments.

⚙️ Verdict: Both are instant — but Raast performs better when you’re sending larger or inter-bank transfers.Integration with Banks & Apps

Raast now powers instant payments across 30+ banks and fintech apps in Pakistan — including HBL, Meezan, Bank Alfalah, NBP, Easypaisa, and JazzCash.

Easypaisa, while expanding, still functions primarily inside its own ecosystem, though Raast integration has opened new bridges to the banking network.

🌍 Winner: Raast — its integration is nationwide and universal, connecting both banks and wallets under one system.Security & Regulation

Both Raast and Easypaisa are fully regulated by the State Bank of Pakistan, ensuring user funds and data stay protected.

However, Raast enjoys an extra layer of credibility — it’s directly owned and operated by SBP, giving it an unmatched trust and transparency advantage over private fintechs.

✅ Trust Score: Raast takes the lead due to its government-backed infrastructure.Raast vs JazzCash: Where Do They Stand?

Just like Easypaisa, JazzCash has also integrated Raast payments into its app.

This means JazzCash users can now send or receive Raast transfers instantly — whether it’s to a bank account or another wallet.

However, Easypaisa still offers extra wallet features like cashback rewards, debit cards, mini-loans, and QR payments that JazzCash and Raast alone don’t provide.

🎯 In short:

- Raast = Best for bank users and free inter-bank transfers

- Easypaisa = Best for daily wallet use and rewards

- JazzCash = Similar to Easypaisa, but with fewer add-on services

Popular Use Cases (Raast vs Easypaisa in Daily Life)

Both Raast and Easypaisa serve millions of Pakistanis — but their ideal users are slightly different. Here’s how each fits into real-world scenarios:

👨💻 For Freelancers

Freelancers working with Upwork, Fiverr, or local clients can use Raast to instantly withdraw earnings to their bank accounts. No waiting, no transfer fees — just smooth, verified deposits.

👪 For Families

Families can use Raast to send money across banks in seconds — perfect for supporting parents, siblings, or relatives nationwide without paying extra transfer costs.

🎓 For Students

Easypaisa remains the go-to app for students — it’s lightweight, easy to use, and supports bill payments, mobile top-ups, and QR transactions in just a few taps.

🏪 For Small Businesses

Small business owners can rely on Raast for large inter-bank transactions with zero fees. Whether paying suppliers or collecting customer payments, Raast offers instant settlement and SBP-level security.

💡 Summary: Raast dominates where bank integration and zero cost matter, while Easypaisa wins for everyday wallet convenience.Pros & Cons Table: Raast vs Easypaisa

| Platform | Pros | Cons |

|---|---|---|

| Raast | ✅ Free transfers ✅ Bank-level security ✅ Nationwide integration | ❌ No standalone app ❌ Limited rewards or cashback options |

| Easypaisa | ✅ Feature-rich app ✅ Cashback & rewards ✅ Debit card support | ❌ Some transfer fees ❌ Limited direct bank integration |

Which One Should You Use in 2025? (Final Verdict)

When it comes to Raast vs Easypaisa 2025, there’s no single winner — it all depends on how you manage your money.

If you’re a bank user, freelancer, or small business owner, then Raast is clearly the smarter choice. It’s officially backed by the State Bank of Pakistan, supports instant inter-bank transfers, and remains 100% free to use. You can move large payments safely and instantly without worrying about fees or limits.

If you’re someone who relies on mobile wallets for everyday tasks, then Easypaisa is still unbeatable. It’s fast, feature-rich, and built for daily bill payments, mobile top-ups, QR payments, and small transfers — now enhanced further with Raast integration for easy bank connectivity.

💡 Best Combo for 2025:

- Use Easypaisa for everyday bills, loads, and shopping

- Use Raast for high-value, business, or inter-bank transfers

Together, they make digital money management in Pakistan faster, cheaper, and more connected than ever before.

Future of Instant Payments in Pakistan

Instant payment in Pakistan is evolving rapidly — and Raast is leading the way.

The State Bank of Pakistan’s digital vision for 2025–2026 focuses on making every type of payment — from merchant transactions and freelancer payouts to government salaries and utility bills — available through Raast’s secure, real-time network.

New updates are already in motion:

- Raast Merchant Payments are being rolled out to shops and small businesses nationwide.

- Freelancers will soon be able to receive global and local payments instantly through integrated banking channels.

- Government institutions are expected to adopt Raast for salary disbursements, pensions, and welfare programs.

At the same time, Easypaisa and JazzCash are expanding their Raast integration, creating a fully interoperable ecosystem — where every Pakistani can send or receive money across any app, bank, or wallet without barriers.

🌍 The future is clear: Raast will power Pakistan’s instant payment infrastructure, while platforms like Easypaisa will continue building the user-friendly experiences on top of it — together driving Pakistan toward a truly cashless digital economy.

Conclusion: Raast vs Easypaisa 2025 — Which One Deserves Your Trust?

By now, it’s clear that both Raast and Easypaisa play vital roles in shaping Pakistan’s instant payment future.

- Raast is the state-backed instant payment network, designed for bank users, freelancers, and businesses who need secure, large-value transfers at zero cost.

- Easypaisa, meanwhile, remains Pakistan’s most user-friendly mobile wallet, perfect for everyday bills, loads, shopping, and QR payments — now even better with Raast integration built in.

💡 My Recommendation:

If you want the best of both worlds, use Raast through your bank for large transactions, and Easypaisa for quick daily payments and rewards.

Both together give you complete control over your digital payments in 2025 — fast, reliable, and safe.

👉 Try it yourself:

- Test Raast through your bank app today — it’s completely free.

- Download the Easypaisa app to experience Pakistan’s most advanced digital wallet.

You can also check out my detailed fintech comparisons:

🔗 JazzCash vs Easypaisa 2025 Guide

🔗 SadaPay vs NayaPay 2025 Comparison

❓ FAQ Section — Raast vs Easypaisa

What is Raast in Pakistan?

Raast is a real-time payment system launched by the State Bank of Pakistan to enable instant, secure, and low-cost digital transfers between banks, wallets, and individuals.

How to use Raast for instant transfers?

Open your banking app, go to the Raast section, and link your CNIC or phone number. You can then send or receive money instantly using the recipient’s CNIC, mobile number, or IBAN.

Is Raast better than Easypaisa in 2025?

For bank users, yes — Raast offers faster, free inter-bank transfers. But for daily wallet users, Easypaisa is better due to its cashback, bill payments, and app-based convenience.

Can I use Raast through Easypaisa?

Yes ✅ Easypaisa now supports Raast transfers directly inside the app. You can send or receive money from any Raast-enabled bank account.

What is the difference between Raast and JazzCash?

Raast is a national payment network owned by SBP, while JazzCash is a private mobile wallet that now uses Raast for inter-bank transfers. JazzCash also offers wallet features like top-ups and QR payments.

Are Raast transfers really free?

Yes, Raast transfers are completely free for individuals — there are no hidden fees or deductions on sending or receiving money.

Is Raast safe for business use?

Absolutely. Since it’s regulated and operated by the State Bank of Pakistan, Raast offers bank-grade security, making it safe for freelancers, SMEs, and businesses.

Can freelancers use Raast for payments?

Yes — freelancers can use Raast to receive payments instantly from local clients and transfer money between banks with no fees.

Does Raast have a mobile app?

No. Raast is not a standalone app — it’s built inside existing bank and wallet apps like HBL, Meezan, NBP, Easypaisa, and JazzCash.

Which is faster: Raast or Easypaisa?

Both are instant, but Raast is slightly faster and more reliable for bank-to-bank transfers, while Easypaisa is faster for wallet-to-wallet payments.

Will Raast replace JazzCash and Easypaisa?

Not exactly. Raast provides the infrastructure, while wallets like Easypaisa and JazzCash build services on top of Raast. They’ll coexist in Pakistan’s digital ecosystem.

Is Raast available for overseas Pakistanis?

Currently, Raast is available for local use only, but SBP plans to expand Raast for international remittances in upcoming phases.

✅ Final Thought:

Pakistan’s digital payment future belongs to both — Raast as the backbone, and Easypaisa as the everyday gateway. Together, they’re powering a cashless revolution in 2025.